Strategies

It’s About

the People

We are operators at heart. Only with a deep understanding of real estate fundamentals can we tap into the creativity that breeds success. Creativity increases with collaboration. Some of our most successful ventures have been in partnership with mavens of their product type. The secret sauce of success is synthesizing operations, leasing and finance into a structure bound by respect, integrity, and talent. That’s what we do.

Investment Focus

Encompassing all of our assets is a value-add strategy seeking to focus on cash-flowing assets with strong appreciation potential structured in a manner that minimizes investor’s tax exposure.

*These metrics are targets only and do not indicate guaranteed results. Potential investors should consult a professional prior to investing.

Middle

Market

Under the radar of the institutional buyers ($50m) and above the fray of the masses ($5m) is where we find the most opportunity to create value.

Secondary

Growth Markets

A desirable location can be interpreted differently by different people. However, data shows trends. Trends are our friends. Our success has primarily been achieved by focusing on secondary markets just outside crowded city centers with fundamental infrastructure problems.

Tax

Strategies

From cost segregation… to self-directed IRA investments…to tax-deferred exchanges, commercial real estate continues to provide substantial tax shelter and estate planning strategies that benefit our investors.

Target

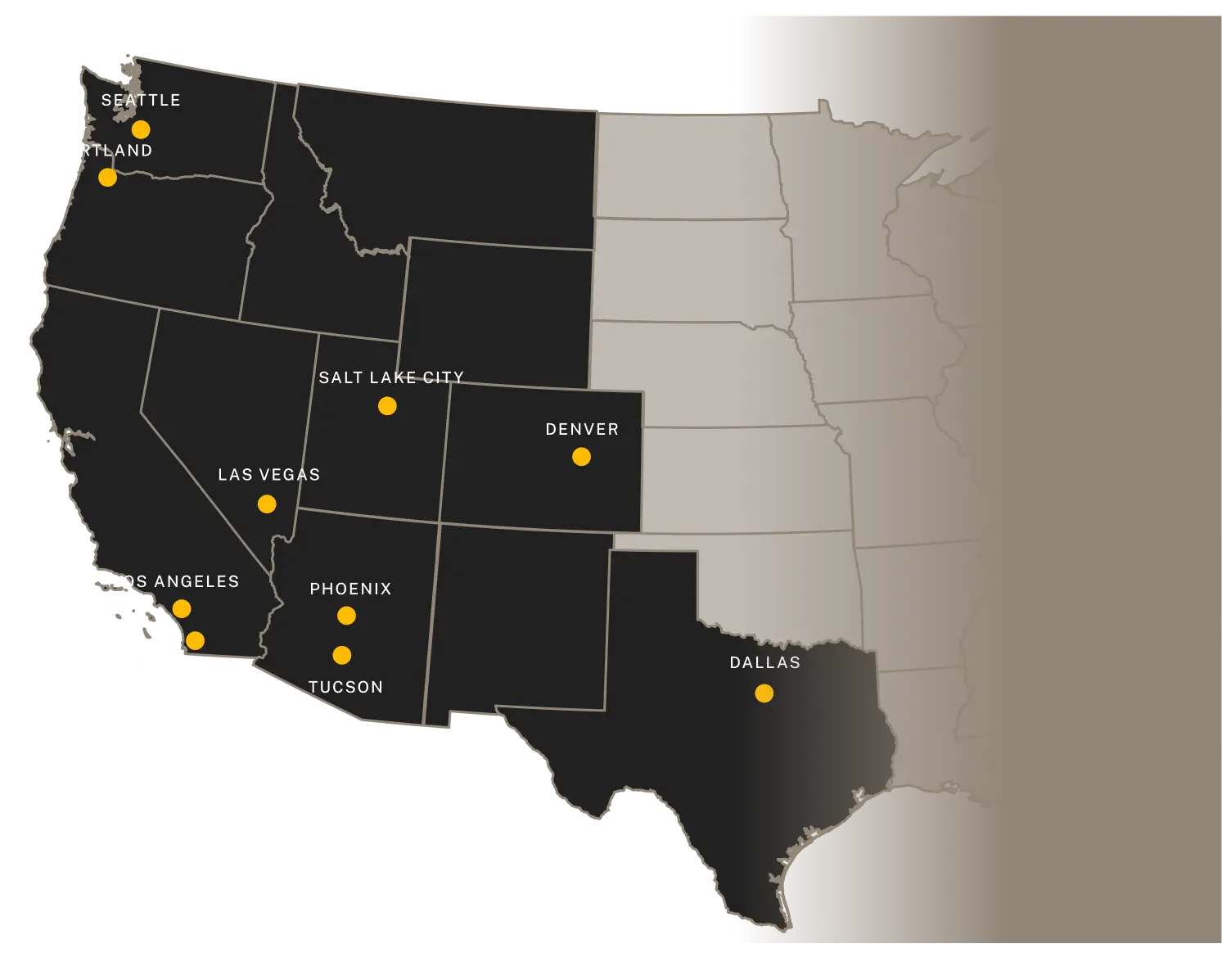

Regions

- Strong, West Coast primary and secondary markets.

- Dense population, employment base.

- Innovation hot-spots such as Portland, Denver, Seattle, Salt Lake City, and San Diego.