Investing with Us

Our Village,

Our Advantage

The commercial real estate industry is really quite small. Accountability and integrity is the currency we use to consistently close deals and perform for our investors.

Investors

We rely on a broad spectrum of accredited investors who benefit from our access to private market opportunities.

- Family Offices

- Private High Net Worth Individuals

- Retirement Funds

- Joint Ventures

- 1031 Exchange

- Discretionary Capital

Operating

Partners

Attention to detail, follow through skills, inclination to leverage new technology… and doing it all with a positive mind-set is embodied in each of our operating partners.

- Legal

- Leasing

- Acquisitions

- Property Management

- Asset Management

- Accounting/Cost-Segregation

- Environmental Consultants

Properties

Each property we acquire typically requires a process of reviewing hundreds of deals, underwriting dozens of them, and speculating significant pursuit costs…all before we even get to the starting line. The properties we buy generally conform to the following parameters:

- Growing Secondary Markets

- Procured “Off-Market”

- Seller is Either Distressed or Unable to Create Value

- Presented by Brokers with Whom We Have a History of Transactions

Investor Experience

Match Investor Needs

Value Creation

Communication & Reporting

Trusted Resource

1031

Exchanges

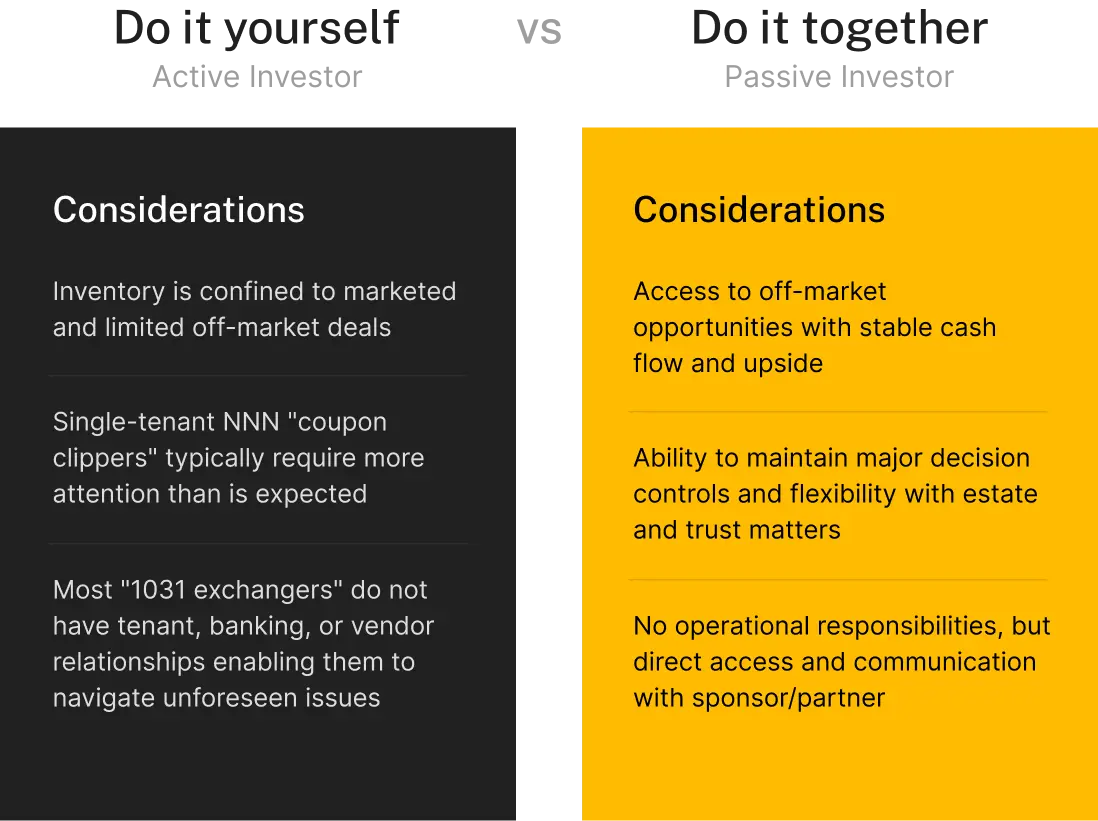

For commercial real estate investors navigating a 1031 exchange and seeking alternatives to single tenant NNN deals or DSTs, consider partnering with us for joint venture opportunities. As an established firm specializing in retail properties, we offer investments that provide stable cash flow and significant upside potential. By collaborating with a seasoned partner, you can diversify your portfolio, leverage our expertise, and maximize the benefits of your 1031 exchange with high-quality retail assets.

FAQs

What are the tax benefits of investing in commercial real estate?

Investing in commercial real estate offers numerous tax advantages, such as accelerated depreciation, which allows investors to shelter a portion of their income each year. Additionally, capital gains tax deferral is possible through 1031 exchanges, enabling investors to reinvest proceeds from the sale of one property into another without immediate tax liabilities.

How do investors benefit from the lack of liquidity in commercial real estate investments?

The lack of liquidity in commercial real estate investments often leads to higher returns compared to more liquid assets. This illiquidity allows for long-term investment strategies focused on value appreciation and stable cash flow. Investors benefit from reduced market volatility and the potential for significant upside as properties appreciate over time.

How many investment opportunities does JS Western provide each year?

JS Western typically offers a limited number of high-quality investment opportunities each year. We focus on carefully vetted properties that meet our stringent criteria for stable cash flow and substantial upside potential.

How does JS Western assist investors with 1031 exchanges?

We provide comprehensive asset management support for investors who desire a truly “hands-off” experience. Our team also assists with identifying suitable replacement properties, facilitating transactions, and ensuring compliance with IRS regulations. This service allows investors to defer capital gains taxes and reinvest their proceeds into high-quality commercial real estate assets.

Does JS Western own assets other than retail properties?

Yes, JS Western’s diverse portfolio includes industrial, medical, and multi-family properties. Our expertise extends beyond retail, as demonstrated in our various case studies, showcasing successful investments across different asset classes.

What are the risks of commercial real estate syndication?

Investing in commercial real estate syndications involves various risks, including market volatility, property management issues, and potential liquidity constraints. Market conditions can affect property values and rental income, while operational challenges may impact overall returns. Additionally, syndication investments are typically illiquid, meaning it can be challenging to sell your share quickly if the need arises.